UX Design Course Project

Chosen Prompt: Design an app and a responsive website that helps friend or family groups manage a household budget and save up for a common goal.

I signed up for this course to build a stronger foundation in UX, especially in terms of research and how UX designers can empower their users through their designs. So far in this course, I have covered concepts such as the design thinking framework, user-centered design, equity-focused design, assistive technology, building personas, and much more. The below page showcases the work I have done so far in this course project.

Design Thinking Phase 1: Empathize with Users

Research goals:

1. I want to figure out common challenges people face when trying to save money.

2. I want to identify what will positively motivate users to stick to their saving goals.

Target Audience:

Ages 18-65

Participants with source of income

Participants of different genders

Participants of different yearly incomes

Participants with disabilities

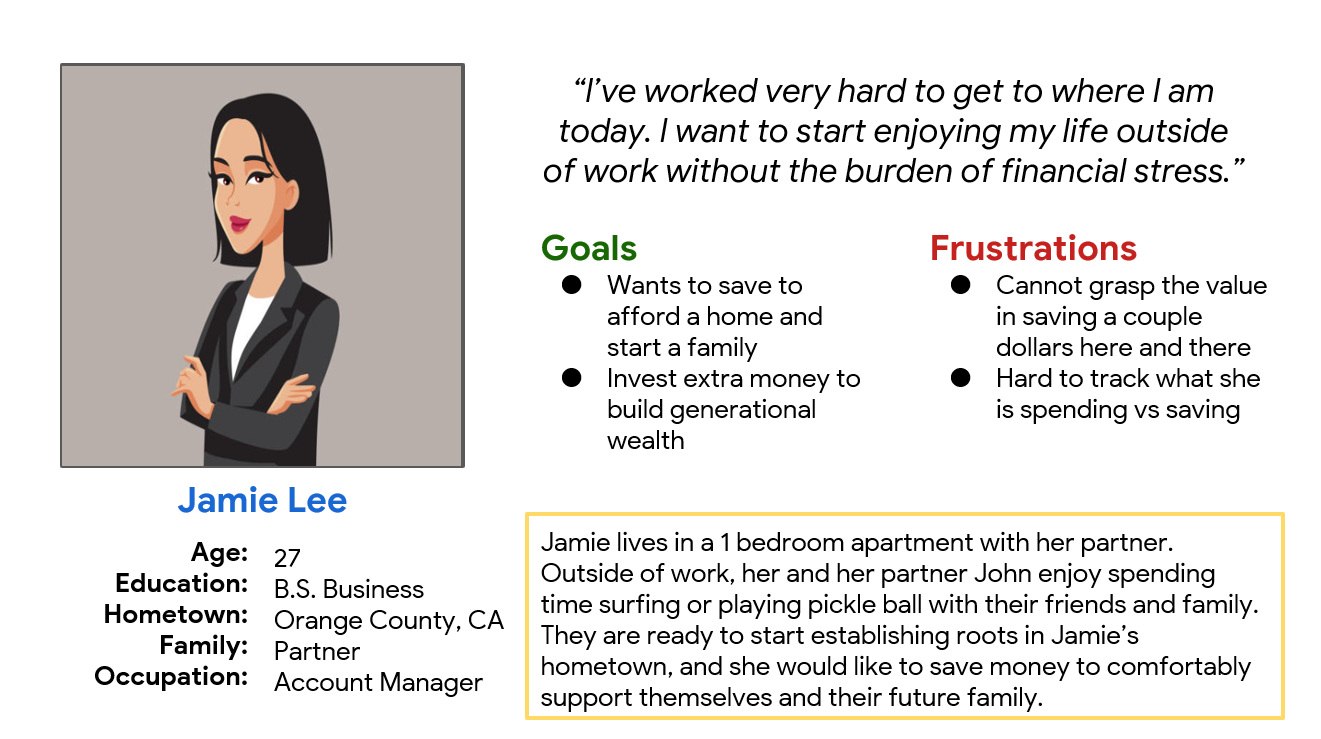

Fictional User Profiles for Empathy Exercise

-

Leo

Age: 45

Education: B.S. in Nursing

Hometown: St. Louis Missouri

Family: Single

Occupation: Nurse

Leo is a nurse who works night shifts in the ER. He spends most of his free time catching up on sleep, and often does not have the energy to cook food. As a result, he tends to eat out most of his meals. He also enjoys going out in the city with friends and visiting different bars.

Leo wants to create new habits that could help him save more money so he can one day buy his own home.

-

Sarah

Age: 19

Education: High School Education

Hometown: Shanghai, China

Family: 3 siblings

Occupation: Student

Sarah is an immigrant to the U.S. who moved with her family after her father was relocated for work. She is still learning English, but hopes to get into a University and pursure a career in Political Science. She currently works as a baker in a small coffee shop.

Sarah hopes to save money for her college applications so that she can take minimal loans out.

-

Stephanie

Age: 28

Education: B.A. in Marketing

Hometown: Los Angeles, CA

Family: Lives with partner

Occupation: Business Owner, Marketing

Stephanie is a Brand Designer who started her own business. She takes client meetings during the day, and switches between working from home and working from different coffee shops. In her free time she likes to take her two dogs out for walks so they are not stuck at home all day.

Stephanie would like to save money for her wedding coming up next year by making contributions every time she completes a client project.

-

Kirby

Age: 60

Education: High School

Hometown: Perth, Australia

Family: Partner, 2 kids

Occupation: Cook

Kirby is a chef at a local restaurant in Perth. Their two children have moved out, and they plan to retire in the next 5 years. Kirby and their partner enjoy spending their free time swimming and catching movies at the theater.

Before retiring, Kirby would like to save money from each of their paychecks to invest in bonds.

User Interview Questions

What are your current financial obligations? How do you balance these costs with saving money?

What does budgeting look like for you currently? Tell me an experience you have with budgeting and how it makes you feel? (Tell me about those challenges)

How do you think these challenges could be resolved?

What do you save money for?